Pet Food Ingredients Market Size to Exceed USD 72.24 Billion by 2034 | Towards FnB

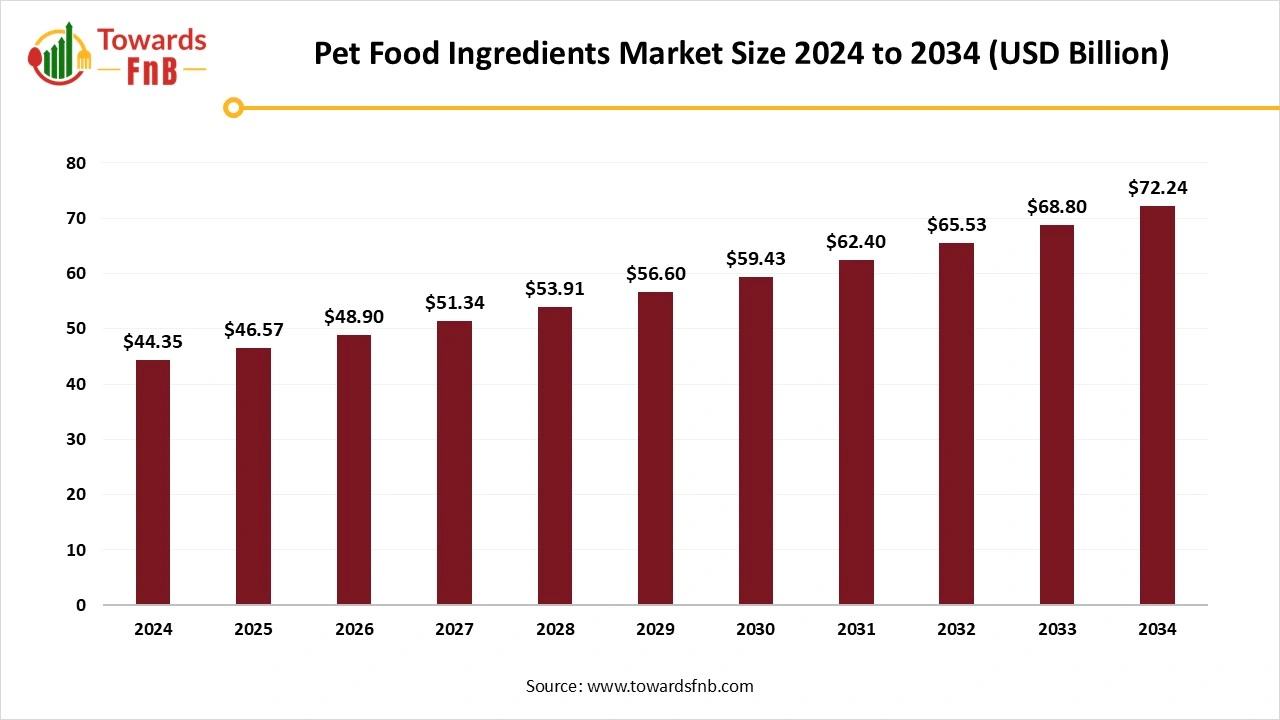

According to Towards FnB, the global pet food ingredients market size is evaluated at USD 46.57 billion in 2025 and is anticipated to surge USD 72.24 billion by 2034, reflecting at a CAGR of 5% from 2025 to 2034.

Ottawa, Dec. 02, 2025 (GLOBE NEWSWIRE) -- The global pet food ingredients market size stood at USD 44.35 billion in 2024 and is predicted to increase from USD 46.57 billion in 2025 to reach around USD 72.24 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market has been experiencing growth lately due to the increasing number of pet owners, higher demand for organic and functional pet food, and a growing desire for transparency to stay informed about pet food ingredients, all of which are contributing to the market's expansion.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5931

Key Highlights of the Pet Food Ingredients Market

- By region, Asia Pacific dominated the pet food ingredients market in 2024, whereas Europe is expected to grow in the foreseeable period.

- By ingredient type, the amino acids segment led the pet food ingredients market in 2024, whereas the gut health ingredients segment is expected to grow in the foreseeable period.

- By pet type, the dogs segment led the pet food ingredients market in 2024, whereas the cat segment is expected to expand in the forecast period.

High Demand for Organic Options is helpful for the Growth of the Pet Food Ingredients Industry.

The pet food ingredients market is expected to grow due to increasing pet ownership, rising demand for healthy pet food, and greater transparency in the pet food industry. Today, pet owners are concerned about the quality and ingredients used in the manufacturing of pet food. Hence, such factors drive higher demand for premium, organic, safe, and healthy ingredients, further fueling market growth.

The market involves the supply of pet food ingredients, both animal- and plant-based, based on the convenience of pet owners. It allows owners to select from a wide range of categories, further propelling the market’s growth. The manufacturers also ensure that the pet food is enriched with vitamins, minerals, omega fatty acids, and other nutrients to support a pet’s overall health. Rising awareness of pet nutrition is another major factor driving market growth.

New Trends of Pet Food Ingredients Market

- Higher demand for premium, customized, and organic pet food options is one of the major factors for the growth of the market.

- Higher demand for protein-rich and grain-free formula for pet food is another major factor helpful for the market’s growth, as pet owners ensure to maintain the quality of their pet’s food.

- Higher demand for single-cell proteins is also gaining traction, helping the market grow due to their sustainability and innovative attributes. Such options are made from protein options such as black soldier flies, algae, and tofu.

- Higher transparency in the use of ingredients also helps to fuel the growth of the market.

- Targeted pet food for specific health considerations is another major factor for the market’s growth.

Impact Of AI on the Pet Food Ingredients Market

Artificial intelligence is reshaping the pet food ingredients market with highly specific improvements in formulation science, quality control, sustainability tracking, and supply chain performance. In research and formulation, AI-powered nutritional models analyze amino acid profiles, digestibility scores, palatability data, and breed-specific nutritional requirements to design optimal ingredient blends for dogs, cats, and specialty pets. These models evaluate how protein such as chicken meal, salmon meal, insect protein, and pea protein interact with fibers, fats, vitamins, and minerals to create complete and balanced diets. AI also simulates ingredient behavior under extrusion or cold pressing to predict texture, kibble expansion, nutrient retention, and palatant adherence, reducing the need for iterative testing.

AI-driven palatability prediction tools analyze pet eating patterns captured through smart feeders and feeding trials. This allows formulators to pinpoint which ingredient combinations improve acceptance for picky eaters or animals with sensitivities. For therapeutic and veterinary diets, AI integrates clinical data, microbiome profiles, and metabolic indicators to tailor ingredients that support renal care, weight management, allergy reduction, and gut health.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/pet-food-ingredients-market

Recent Developments in the Pet Food Ingredients Market

- In November 2025, Reliance Consumer Products Ltd launched their new pet food brand- Waggies, an affordable, science-backed nutrition for pets. The brand's primary aim is to align with Reliance’s broader FMCG expansion through strategic partnerships and acquisitions to strengthen its market presence.

- In November 2025, Charm Pet Food launched a new pet food line made with high-quality formulas for dogs and cats.

Product Survey of the Pet Food Ingredients Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or End Use Segments | Representative Ingredient Suppliers or Brands |

| Animal Protein Meals | High-protein rendered ingredients are used as primary protein sources. | Chicken meal, turkey meal, beef meal, lamb meal, pork meal | Kibble, treats, wet food | Tyson Pet Ingredients, JBS, Smithfield Foods |

| Fish and Marine Proteins | Marine-based proteins are rich in omega-3 oils and essential amino acids. | Salmon meal, herring meal, whitefish meal, krill meal | Skin and coat formulas, senior diets, sensitive stomach | BioMar, Omega Protein, Aker BioMarine |

| Fresh and Frozen Meats | Chilled or frozen raw meats are used for high meat inclusion formulas. | Fresh chicken, beef, lamb, venison | Fresh pet food, wet food, premium kibble | Cargill Raw Ingredients, Aussie Pet Feed |

| Meat By-Products and Organ Ingredients | Nutrient-dense internal organs with natural vitamins and minerals. | Liver, heart, kidney, tripe | High protein diets, raw diets, wet food | Rendering companies, pet ingredient processors |

| Plant-Based Proteins | Alternative protein sources for allergen control or sustainability. | Pea protein, potato protein, lentil protein, chickpea flour | Limited ingredient diets, weight management | Roquette, Ingredion, Cosucra |

| Egg Derived Ingredients | High-digestibility proteins are used for sensitive and high-performance diets. | Egg powder, egg albumin, egg hydrolysate | Senior diets, allergen-friendly formulas | Kewpie, Rose Acre Farms |

| Carbohydrate Sources and Grains | Energy-providing grains and starches for balanced nutrition. | Rice, barley, corn, sorghum, oats | Dry kibble, baked treats | ADM, Purina Ingredient Sourcing |

| Novel and Exotic Proteins | Proteins are used in limited-ingredient or hypoallergenic diets. | Duck, rabbit, bison, kangaroo, alligator | Veterinary diets, hypoallergenic products | Australian Wild Game Suppliers, Exotic protein processors |

| Insect Protein Ingredients | Sustainable emerging proteins for eco friendly pet foods. | Black soldier fly meal, cricket meal | Grain free, novel protein diets | Protix, Ynsect, Enterra Feed |

| Fruits and Vegetables | Plant based ingredients providing fiber, antioxidants, and micronutrients. | Sweet potato, pumpkin, carrots, blueberries | Holistic diets, grain free kibble | Drum Drying Co., vegetable flake suppliers |

| Functional Fibers | Dietary fibers supporting digestion, stool quality, and satiety. | Beet pulp, chicory root (inulin), cellulose, psyllium | Gut health formulas, senior diets | Lucta, International Fiber Corp |

| Oils and Fats | Fat sources for energy, palatability, and skin health. | Chicken fat, salmon oil, flaxseed oil, sunflower oil | Wet food, kibble coating, skin and coat diets | Rendered fat suppliers, Omega oil producers |

| Vitamins and Mineral Premixes | Fortification systems ensuring complete and balanced nutrition. | Vitamin A, D, E premixes, zinc, iron, calcium | All commercial diets | DSM Firmenich, Nutreco, Kemin |

| Amino Acid Supplements | Purified amino acids used to balance protein profiles. | Taurine, methionine, lysine | Cat food, performance diets | Ajinomoto Animal Nutrition |

| Probiotics and Prebiotics | Gut health ingredients improving microbiome stability. | Lactobacillus strains, Bacillus coagulans, inulin | Digestive diets, immune support diets | Alltech, Chr Hansen, BSM Innovations |

| Antioxidants and Preservatives | Protect fats from oxidation and maintain shelf life. | Natural mixed tocopherols, rosemary extract | All kibble and wet food formats | Kemin Industries, Cargill antioxidants |

| Flavor Enhancers and Palatants | Coating agents increasing palatability and intake. | Chicken digest, liver digest, spray dried broths | Kibble coatings, wet food palatability | AFB International, Symrise Pet Food |

| Binders and Texturizers | Improve kibble structure and moisture retention. | Guar gum, xanthan gum, carrageenan, gelatin | Wet food, semi moist treats | CP Kelco, DuPont Nutrition |

| Starches and Functional Carbohydrates | Provide texture, extrusion performance, and digestible energy. | Potato starch, tapioca starch, corn starch | Kibble manufacturing, soft treats | Ingredion, Cargill Starch Solutions |

| Herbal and Botanical Additives | Natural plant ingredients offering functional wellness benefits. | Rosemary, turmeric, ginger, chamomile | Holistic diets, senior formulas | Botanical extract suppliers |

| Enzyme Blends | Digestive enzymes added to improve nutrient absorption. | Protease, amylase, lipase blends | Senior diets, sensitive stomach | Novozymes, Alltech enzymes |

| Yeast Based Ingredients | Yeast products used for immune support and palatability. | Brewer’s yeast, nutritional yeast, yeast beta glucans | Immune diets, kibble palatants | Diamond V, Lesaffre |

| Hydrolyzed Protein Ingredients | Proteins broken down into smaller peptides for allergy friendly diets. | Hydrolyzed chicken, hydrolyzed soy, hydrolyzed fish | Veterinary diets, sensitive stomach | Nestlé Purina ingredients, Hill’s suppliers |

| Freeze Dried and Dehydrated Ingredients | High-quality dehydrated meats and vegetables for raw-inspired diets. | Freeze-dried chicken, beef crumbles, vegetable flakes | Premium raw alternative foods | Stella and Chewy’s suppliers, freeze-dry processors |

| Grain-Free Carbohydrate Alternatives | Substitutes for grain-free diet formulations. | Peas, lentils, chickpeas, tapioca | Grain-free kibble, limited ingredient diets | Global pulse processors |

| Collagen and Joint Health Ingredients | Functional ingredients supporting joint mobility. | Collagen peptides, glucosamine, and chondroitin | Senior pets, mobility diets | Gelita, Bioiberica |

| Natural Colorants and Additives | Improve appearance while remaining clean label. | Paprika, annatto, caramel color | Treats, wet food | Natural color suppliers |

| Sweeteners for Pet Treats | Pet safe sweeteners for palatable treats. | Molasses, honey, vegetable glycerin | Treats, baked snacks | Ingredient suppliers to treat manufacturers |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5931

Pet Food Ingredients Market Dynamics

What are the Growth Drivers of the Pet Food Ingredients Market?

Rising pet ownership, high demand for premium, organic, and functional pet foods, and greater transparency are major drivers of market growth. Such food options are rich in protein and other nutrients, further fueling market growth. Targeted food ingredients, such as healthy gut ingredients like probiotics or prebiotics, or overall health, also help elevate the industry. Technological advancements, such as AI and ML, also help formulate customized pet food options, which is another major factor driving the market’s growth. The market is also seeing growth due to the high demand for premium food options among Gen Z pet owners.

Challenge

Supply Chain and Cost Issues May Hamper the Market’s Growth

The high costs of pet food ingredients, such as meat, organic produce, high-protein fats, and essential nutrients, are major factors that can obstruct the market’s growth. High raw-material prices affect the final product's prices as well, and these factors also affect the market’s growth. Issues in the supply chain, such as shortages, delays, climatic challenges, and other factors, may also obstruct the growth of the pet food ingredients market.

Opportunity

Availability of Health-focused Ingredient Options is helpful for the Market’s Growth

Today, pet owners are focused on providing premium, organic, and functional pet foods to their pets. It helps them target specific health conditions in their pets, such as ingredients that support gut, hair, skin, or overall health. Such pet food options help to fuel the market’s growth. These food options provide essential nutrients such as protein, vitamins, minerals, omega-3 fatty acids, and others.

Trade Analysis of the Pet Food Ingredients Market

-

Global Exporter Leadership

The United States, China, Belgium, New Zealand, and Thailand are the most significant exporters of processed pet food products and higher-value pet food ingredients by export value in recent reporting. The United States remains a leading supplier of specialised, high-margin finished and semi-processed pet food ingredients, supported by shipments of meat, rendered proteins, and functional premixes.

United States shipments to China alone exceeded USD 300 million in 2022, reflecting strong growth in China’s demand for imported, safety-assured nutrition inputs. China and Thailand continue to export commodity proteins and dried meat meals that supply regional manufacturing bases. New Zealand recorded rapid export growth driven by premium meat and dairy-derived ingredient lines, with shipments to China reaching NZD 134.3 million for the year ending June 2023.

-

Representative Country Snapshots

India exported dog and cat food valued at about USD 73.02 million in 2023, with documented shipments to the Middle East, Bangladesh, and African markets. This reflects India’s role as an ingredient supplier and regional co-packer for dry kibble and treat products. Belgium continues to operate as a European hub for flavourings, vitamin-mineral premixes, hydrolysed proteins, and functional concentrates, shipping them to European integrators and private label manufacturers. Brazil and the United States supply bulk rendered proteins and poultry byproduct meals into Southeast Asia and Mexico. At the same time, the Netherlands and Germany export concentrated functional ingredients and emulsifiers to northern European formulators.

-

Shipment vs Value Dynamics and Form Factors

Trade flows fall into three clear logistics and value tiers. Tier 1 consists of finished and semi-finished high-unit-value ingredient shipments, including hydrolysed proteins, specific amino acids, nutraceutical premixes, and patented probiotic strains. These lines are usually palletised and moved in temperature-controlled containers to formulation centres. Tier 2 consists of mid-value concentrates and functional powders, such as rendered meals, collagen preparations, and flavour systems, shipped in bulk bags or ISO containers.

Tier 3 consists of commodity feed-grade proteins, fish meal, and grain-based carriers shipped in bulk tonnage at low unit value. Customs and HS-level transaction data repeatedly show that Tier 1 units achieve significantly higher unit values than Tier 3 volumes, making value signals useful in distinguishing premium ingredient flows from bulk protein shipments.

-

Importer Profiles and Demand Hubs

Import demand is concentrated in three buyer clusters. The first cluster consists of premium pet food markets and contract formulators in the United States, the European Union, Japan, and South Korea. These markets import certificated and traceable functional ingredients and premixes to support regulated product categories.

The second cluster comprises fast-growing East and Southeast Asian manufacturing hubs, including China, Thailand, Vietnam, and Indonesia. These hubs import rendered proteins, dehydrated meats, and specialty additives to supply domestic brands and regional distributors.

The third cluster consists of Middle East and Gulf markets that import finished kibble and blended ingredient packs from India, the European Union, and Brazil. Aggregate reporting for 2023 shows feed, feed ingredients, and pet food exports valued at about USD 13.4 billion, highlighting how closely pet ingredient trade is linked to wider feed commodity flows and the regulatory rules governing market access.

Pet Food Ingredients Market Regional Analysis

Asia Pacific Dominated the Pet Food Ingredients Market in 2024

Asia Pacific dominated the pet food ingredients market in 2024 due to factors such as rising pet ownership, increased demand for organic and functional pet food options, greater transparency, and demand for plant-based pet protein. Such factors lead to higher demand for both animal and plant-based pet food options, which supports the market’s growth. India has made a major contribution to the market's growth, driven by rising pet ownership and consumer awareness of the benefits of the functional and organic pet food segment.

Europe Is Observed to Be the Fastest-Growing Region in the Foreseeable Period

Europe is expected to be the fastest-growing region over the forecast period due to high demand for premiumization, customization, and nutritional pet food options. Consumer awareness of nutritional pet food targeting specific pet health concerns also helps fuel the growth of the pet food ingredients market in the foreseeable future. Rising pet ownership, coupled with Gen Z pet owners' demand for high-quality pet food options, is another major factor driving the market’s growth in the region. Germany has made a major contribution to the regional market's growth due to rising pet ownership, customization, and higher demand for grain-free and protein-rich pet food formulas.

North America Is Observed to Have a Notable Growth in the Foreseeable Period

North America is expected to see notable growth over the forecast period due to rising pet ownership, premiumization, customization, and demand for high-quality pet food. Consumer awareness regarding the importance of nutritional pet food to support specific health conditions olso helps tuel the market’s growth. Hence, pet owners highly demand pet food that is healthy for the gut, joints, skin, and hair in the US plays a major role in the regional market's growth due to rising pet ownership and high demand for functional, clean-label pet food options to support their gut health and overall well-being.

Pet Food Ingredients Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 5% |

| Market Size in 2025 | USD 46.57 Billion |

| Market Size in 2026 | USD 48.90 Billion |

| Market Size by 2034 | USD 72.24 Billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Pet Food Ingredients Market Segmental Analysis

By Ingredients Type Analysis

The amino acids segment dominated the pet food ingredients market in 2024 due to its high demand, as it supports protein synthesis, muscle growth, and immune function, thereby fueling market growth. Such pet food options are essential for the overall development of the pet and its organs, thereby enhancing immunity. Such options are also essential for premiumizing and customizing pet food to targeted pet health benefits. Hence, the segment makes a major contribution to the market's growth.

The gut health ingredients segment is expected to grow over the foreseeable period due to greater consumer awareness of the importance of gut health and its connection to food. Hence, pet owners are increasingly demanding pet food options that support gut health to promote smoother digestion, prevent digestive issues, and maintain overall health. The segment also observes growth due to higher demand for pet food options made from healthy, organic, functional, and high-protein ingredients to enhance pet immunity, further fueling the market's growth in the foreseeable period.

By Pet Type Analysis

The dog segment dominated the pet food ingredients market in 2024 due to rising dog numbers, higher demand for premium, organic, and functional dog food, and greater demand for protein-rich options. Such options altogether help fuel the market's growth. The dog segment also observes growth due to rising disposable income, a growing population of Gen Z pet owners, and higher demand for functional pet food options featuring prebiotics, probiotics, and protein-rich ingredients, further fueling the market’s growth.

The cat segment is expected to grow at a notable rate over the forecast period due to rising cat ownership compared to dogs. Hence, it further leads to higher demand for premium cat food options, customization, and functional cat food options to meet specific feline requirements. Rising cat ownership observed in apartment culture is another major factor fueling the market’s growth. Higher demand for cat food options that help align cats’ urinary, digestive, and other health conditions is another major factor driving the market’s growth.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Pet Food Ingredients Market

- Biorigin – A leading producer of natural yeast-based ingredients used to enhance pet food palatability, digestibility, and nutritional performance. The company focuses on sustainable fermentation-derived solutions, including beta-glucans and postbiotics.

- Lallemand, Inc. – Specializes in yeast, probiotics, and microbial fermentation ingredients for animal nutrition. Its pet food portfolio supports gut health, immune function, and improved nutrient absorption.

- Eurotec Nutrition – Provides functional and nutritional additives for the pet food and livestock sectors, including enzymes, vitamins, and specialty blends. The company focuses on improving feed efficiency and overall animal wellness.

- Impextraco Ltda Brazil – A global supplier offering mycotoxin binders, gut health additives, and performance enhancers for animal and pet diets. The company emphasizes safety, quality control, and advanced formulation technologies.

- Pancosma – A Swiss provider of plant-based extracts, organic trace minerals, and flavor modifiers used widely in premium pet nutrition. The company is known for science-backed natural ingredients that support immunity and gut performance.

- Alltech – An international leader in fermentation-based pet food ingredients including yeast products, enzymes, and organic minerals. Its solutions target digestive health, immune modulation, and overall pet vitality.

- Vitablend Nederland B.V. – Supplies antioxidants, nutrient premixes, and custom microencapsulated ingredients for pet food manufacturers. The company focuses on stabilizing fats, extending shelf life, and enhancing product quality.

- Elanco – A major animal health company offering nutritional enhancers, functional additives, and wellness-supporting ingredients for companion animals. Its portfolio supports coat health, digestion, and long-term pet vitality.

Segments Covered in the Report

By Ingredient Type

- Specialty Proteins

- Beef Proteins

- Egg Proteins

- Blended Proteins

- Hydrolyzed Proteins

- Pork Protein

- Fish Protein

- Poultry Protein

- Ovine Proteins

- Cervine Proteins

- Other animal Proteins

- Plant Proteins

- Algal proteins

- Amino Acids

- Lysine

- Methionine

- Threonine

- Cysteine

- Others

- Mold Inhibitors

- Gut Health Ingredients

- Beta-glucan

- Cereals

- Mushroom

- Yeasts

- Seaweed

- Phosphates

- Monocalcium

- Dicalcium

- Phospholipids

- Others

- Vitamins

- Water-soluble

- Fat-soluble

- Acidifiers

- Carotenoids

- Astaxanthin

- Beta-carotene

- Zeaxanthine

- Lutein

- Others

- Enzymes

- Phytases

- Carbohydrases

- Proteases

- Others

- Mycotoxin Detoxifiers

- Flavors & Sweeteners

- Antimicrobials & Antibiotics

- Minerals

- Antioxidants

By Pet

- Dog

- Cat

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5931

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.